Top 3 Reasons Hospital CFOs Don’t Hire CDM Consultants

Posted by Mitch Mitchell on Mar 12, 2012

I once had a conversation with a local consultant friend of mine who has a unique career. What he does is goes into businesses, finds profit leaks, finds ways to help them save money on many different things, and then takes a percentage of the savings as his pay. If he finds nothing, he gets nothing.

At the time I said that he must always be busy and he said, incredibly, that it didn't work that way. He said that even with his business model he found it hard to get businesses to go for the proposal for mainly two reasons. One, many corporate CFOs (chief financial officers) didn't understand what it was he did, even when he explained it. Two, they worried that he would make them look bad, even though he told them he always shared credit, and that it would jeopardize their credibility within the organization. Lucky for him, he's always managed to get just enough business to live okay, but he said that he wouldn't mind being a bit busier.

I can fully understand what he was saying then because it's what I go through as well. I offer CDM, or charge master services, to hospitals. I'm very good at it; my track record shows that. And yet I'm not nearly as busy as I'd like to be. It's a strange conundrum because the industry isn't replete with people who do this type of work, especially not small businesses. I can offer access and affordability that larger companies can't come close to touching.

As I said, there's not a lot of people doing what I do. And yet, I've talked to enough of them, as well as consultants that provide other interim health care financial services, to have gotten quite an education on what the issues are. Out of the three things I'm going to highlight I knew about two of them but the third one I really hadn't thought applied to health care.

Why reveal these things now? Won't I run the risk of alienating an entire industry of CFOs or VP's of Finance at hospitals around the country? Possibly, but there comes a time when one has to address the realities of life so that they can be answered. If it's true of diversity initiatives it's definitely true here. Let's go; the top 3 reasons CFOs don't hire CDM consultants are:

1. They don't know what we do. No one goes to college and learns how to be a hospital CFO. It's a much different world than any other business. An overwhelming majority of hospital CFOs started in other businesses instead of working in hospitals. Many were auditors, but these days a high number of hospitals CFOs come from other businesses with no health care background. They get a crash course on things, but they never really understand what the people who report to them do.

Don't believe me? Let's look at the departments that traditionally report to a CFO:

* Revenue Cycle, which includes registration, billing and collections; I've never met a CFO who's actually ever done any of these jobs. Most of them don't even have access to look at a registration or a medical billing screen.

* Materials Management, also known as purchasing; they don't know what most medical supplies are, only their costs.

* Information Technology; I know some CFOs that have a great understanding of PCs, although not many, but the nuts and bolts of IT, encryption, coding, etc... nope.

* Medical Records; I've never met a CFO that knows how to read a medical record to have a chance at doing either diagnosis coding or determining a procedure code.

* Accounts Payable; this is their strong suit, doing all the accounting, paying bills, doing budgets.

Where does charge master fit in? Actually it mainly fits in under revenue cycle but it's so much more than that. The person responsible for the charge master should also be responsible for making sure that every department within the hospital understands the process of capturing charges as well as participates in the process of verifying the procedures they do so that everything can be coded properly. However, because many CFOs don't know what the real purpose of a charge master is (to be fair, most of their staff doesn't really get it either), it's neglected fairly often. Studies have shown that most hospitals only have it looked at every 3 to 5 years; if you've waited that long you've hurt your hospital's revenue and cash greatly.

2. They don't understand why we charge what we do. As with most businesses, people tend to undervalue the work of people that offer services independently. You may not think a plumber is worth $80 an hour until you've sprung a leak you can't stop. You may scoff at the $92.50 an hour you're paying the guy fixing your car but if you had the skills to do it then you wouldn't need someone who's trained hours, sometimes years, to do it skillfully.

I'm going to divulge something that my competitors probably don't want getting out. The average rate for a standard CDM review, eliminating a lot of additional services, runs between $15,000 and $25,000 depending on the size of the hospital. Large consulting companies will charge tens of thousands more, and of course if it's a very large hospital it's going to cost them more as well.

On the surface that sounds like a lot of money; trust me, it's not unless your charge master is up to date and you have an expert already working at your hospital. If that's the case you don't need a consultant. However, if you haven't had your CDM updated in at least 18 months you're going to have a lot of issues. Every year there's a least 400 or more changes to procedure codes, which includes new codes, deleted codes, and codes where the descriptions have been altered to reflect a different way of looking at a service.

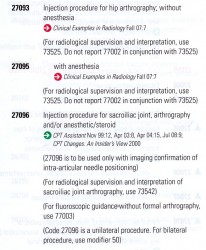

|

These types of things take time to figure out. Luckily, some departments have services that remain standard most of the time, like radiology. But just 3 years ago an entire series of charges related to fluoroscopy were deleted and moved to a totally different section with brand new CPT codes, and hospitals that missed it suddenly were seeing a lot of denials and that costs money.

Next there's the time in talking to representatives of each department. Depending on the size of a facility and the availability of the people you need to talk to that can take anywhere from 2 days to a week.

Then there's the reporting work. When you're reviewing the CDM up front you take a lot of notes because that's what you're going to talk to all these hospital people about. When all that is over there's the work in putting together a report of all findings, which includes all the things you learned from the interviews. If there were other services requested of the consultant that's more time once again.

The end result usually comes to a CDM review finding hundreds of thousands of dollars in real revenue that the hospital hasn't been capturing. I'm being generous with that figure. At one hospital some years ago a conversation with the lab department for 30 minutes ended up finding lost revenue that, when I did my calculation later on, was going to come to a gross figure of between $2 and $5 million dollars a year; yes, I wrote a year. If someone finds you $2 to $5 million a year, are you seriously going to say that it wasn't worth even $40,000 for a CDM review? Even if the figure ended up only coming to $500,000 a year in new revenue, which will probably translate into an increase of between 20% and 40% in your cash, wasn't the one time fee you paid worth that?

3. Worry about being made to look bad. This goes back to what my consultant friend had told me years ago, and I had never thought it was an issue in hospitals. Turns out I was way wrong, and that I'd just worked for CFOs who were pretty cool with the whole thing. What's the issue? Supposedly many CFOs are worried that someone will look at them and wonder why they didn't find all that revenue themselves.

Does it happen? Yes it does, and the reason for that is because many CEOs also don't know what working a CDM takes. But for the most part if the findings are large all anyone cares about is that they're going to show a great infusion of cash and revenue and their hospital is going to benefit.

Here's the thing. Independent consultants are not after anyone's job. We're here to try to help fix things, which is a different thing that what you'll often get from many large consulting companies (yes, there will be a post coming on that as well). Most hospital CEOs will be supportive of a CFO who allows someone with specific knowledge they don't have to come in and help a hospital increase their revenues, no matter the amount.

It's not the fault of the CFO or VP of Finance that there's things about their job that they don't know; that's standard of every job in a hospital. You can bet the VP of Nursing Operations doesn't know how to do a radiology study, and that person has a true medical background. The scope of worry should always be about helping to make your hospital as efficient as possible, whether it's financial or procedural. And by the way, some CDM consultants will offer to take on the project for a small expense amount with a caveat of back end payment of services based on if they discover significant amounts of revenue. That's a safe way to get a review performed although it will probably cost you more money, based on just how much revenue is found, and you might be better off going with a standard project fee (can you imagine how much more money I could have made off that one hospital with just lab in my pocket?).

There it is, all out in the open. What's your next move? Will you be mad at me for calling it out? Do you want to find a disagreement in what I've said? Or would you like to get help in finding revenue to help your hospital, your budgeting, and your cash? There are never any promises, but you can always call or write me, we can have a conversation, and who knows what might happen? If not me then someone; no, let it be me. 😉

This is kinda cool.. It’s like all or nothing job. Thanks for sharing this.. Good job!

Nicole, it really is like an all or nothing job, which is somewhat disappointing.

Mitch, I think you show many people what is all about and this is definitely that can’t be learned at school. I think for many years, money get lost somewhere or in someones pocket.

Carl, there’s definitely a loss somewhere along the line, and it’s too bad because it impacts my ability to make a living.

Thanks Mitch – good post. I have to admit that I was pretty ignorant about CDM consultants too once upon a time… but not any longer. 🙂

Panchadcharam Mahendrarajah

Pan (yeah, I’m not typing the long name lol), do you do any work with CDMs at all?